When a government entity posts volumes of financial information online for public inspection, it can be daunting to sort through the mountains of material available. When it comes to long-term debt obligations, this can certainly be the case for those not schooled in government accounting methods or procedures.

For example, many folks don't realize that when voters approve an overall amount on a bond election that the government entity may not necessarily go out and sell those bonds right away - especially when it entails long-term infrastructure projects like roadways. Sometimes the county may “match” funds with cities and towns, and the county wait to sell a portion of bond amounts until a number of our local partners are ready to being their projects.

That said, we thought it might help to post some details about Collin County's debt that could, at a minimum, explain what we owe and what those funds went to develop. Our

Budget & Finance Department put the following graphs and charts together for this page from their resources and with information from our

County Auditor. We want to mention that the graphs and figures below are as of fiscal year 2022. Also, we realize that many of the graphs here cover large periods of time, so if you need a closer look, please click on the graphs for a larger view.

The following explanation of Collin County's capital financing guidelines starts at

Page 212 of the Capital Improvement Program section in ourFY 2022 Adopted Budget.

Collin County relies on input from various different entities and sources to determine project needs. Each type of capital project has its own selection process for deciding what project gets funded, but they all are funded with debt.

Collin County has four types of

active capital projects: transportation infrastructure, open space, facilities and information technology.

City and County Road projects are guided by Collin County's

Mobility Plan. The Mobility Plan is updated every five years and includes input from

Commissioners' Court, the Planning Board, the

Engineering Department, 31 local governments, Dallas Area Rapid Transit, and North Central Texas Council of Governments. Input through public workshops from residents and others utilizing the road ways is also considered. A committee of citizens evaluates submitted projects and makes a recommendation to Commissioners' Court.

Facility projects are based on the input of county departments such as the Building Superintendent and elected officials. A space study is done each year to determine if the office space available is sufficient to meet the needs of each department as well as project future staffing levels to aid in determining when expansion is necessary.

Open Space projects are submitted through the Project Funding Assistance Program. Entities eligible for funding include municipalities, nonprofits, school districts and nonpolitical groups. All applications are reviewed by the Collin County Parks Foundation Advisory Board. Project goals must be similar to and support or advance the mission published in the Collin County Parks and Open Space Strategic Plan. The advisory board reviews all applications and makes a recommendation to Commissioners' Court for what projects should be funded. In the 2018 Bond Election, Proposition 3 set aside $10 million for Open Space projects. Each year for five years (2019-2023) $2 million will be sold and available for projects.

Tax Note project priorities are based on department and elected official input much like facility projects. The County relies on the Information Technology Department heavily for guidance on the need for Technology enhancements. Requests for enhancements are also received from elected officials and other department heads. Most technology projects are cash funded in the General Fund and so are not considered capital improvement projects. Tax Notes are not utilized as often as the other four types since they are short term debt and don't require voter approval.

The County's legal limits on debt are stated in the

Constitution of the State of Texas, Article 3, Section 52. It says that by an affirmative vote of two-thirds majority of the voting qualified voters of the county, the County may issue bonds or otherwise lend its credit in any amount not to exceed one-fourth of the assessed valuation of the real property of the County. The County must set up a sinking fund and levy and collect taxes to pay the interest and principal of the annual required debt service until the debt is retired.

The County's legal limits on debt are stated in the

Constitution of the State of Texas, Article 3, Section 52. It says that by an affirmative vote of two-thirds majority of the voting qualified voters of the county, the County may issue bonds or otherwise lend its credit in any amount not to exceed one-fourth of the assessed valuation of the real property of the County. The County must set up a sinking fund and levy and collect taxes to pay the interest and principal of the annual required debt service until the debt is retired.

Collin County's debt limit is

25% of assessed value of real property. The assessed value of the real property in the County is

$155.3 Billion and one quarter of this amount is

$38.8 Billion. Collin County's total debt is

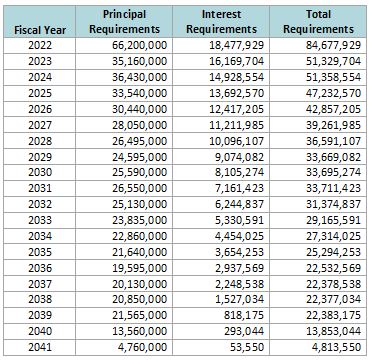

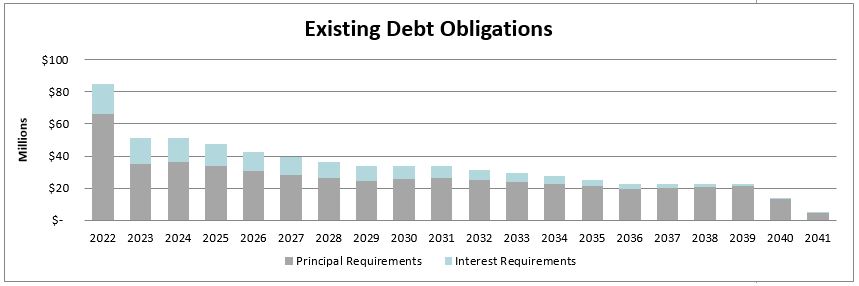

$675.9 Million to be paid over the years until 2041.

The County relies on the advice of a professional outside financial advisor and its own financial officers about when it is advisable to issue new debt. A guiding principle on the issuance of new debt is the desire of the County to continue to maintain AAA

bond ratings. Only 7 of the 254 counties in the state of Texas have been assigned AAA/Aaa ratings. We are well within the permissible limits set out by these advisors to continue with this goal. Details about Collin County's Bond Issues can be found at

emma.msrb.org.

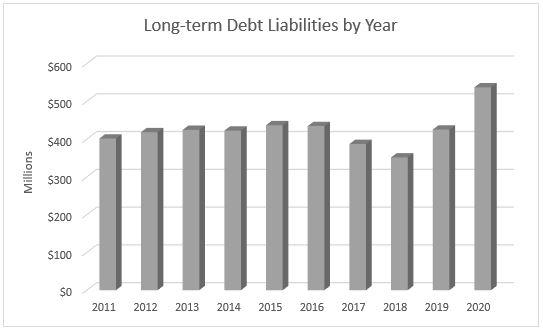

Below outlines Collin County's debt obligation by fiscal year for the last 10 years.

This graph takes a look at the annual payout schedule of our current, existing debt. This would exclude any future voter-approved bond elections to raise funds for further infrastructure expansion.

Again, more details are available on these from our

FY 2022 Adopted Budget.

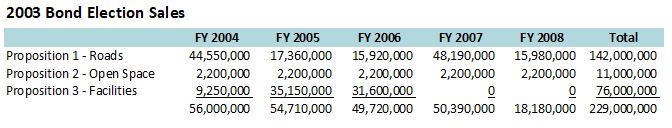

On November 3, 2003, Collin County called a bond election totaling $229 million on three propositions. Proposition One was to issue bonds in the amount of $142 million for construction, maintenance and operation of roads and turnpikes throughout the County, including participation in the cost of joint State Highway and joint city projects. Proposition Two was to issue bonds in the amount of $11 million for the purpose of acquiring and improving land for park and open space purposes, including joint county-city projects. Proposition Three was to issue bonds in the amount of $76 million to acquire, construct, improve, renovate and equip juvenile and adult detention facilities, including court facilities and acquisition of land. The voters of Collin County approved all three propositions. The schedule for the construction of the projects approved in this bond election was coordinated with the County's Debt Management Plan to ensure that projected capital funding requirements were consistent with plans for the sale of authorized General Obligation bonds and tax notes.

In addition to the $229,000,000 from the 2003 Bond Program, short-term debt was sold to fund important acquisitions and projects for the County. Some of the items funded with short-term tax notes include court imaging, the web project, fiber and the voice over internet protocol phone system. $25,000,000 in short term debt was sold to purchase an Enterprise Resource Planning System and a Judicial System. The Enterprise Resource Planning System included accounting, reporting, purchasing, human resources, budgeting, fleet, building permits and other core software needs. The new Judicial System integrated the District, County and Justice of the Peace Courts with the District and County Clerks offices as well as the District Attorney.

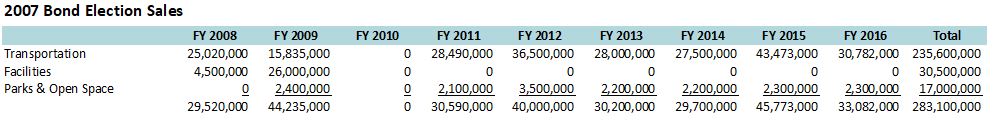

On November 6, 2007, Collin County called a bond election totaling $328.9 million on three propositions. The Commissioners Court set the funding for the 2007 Transportation Bond at $235.6 million, the Facilities Bond at $76.3 million and the Parks & Open Space Bond at $17 million.

The voters of Collin County approved all three propositions. The schedule for the construction of the projects approved in this bond election were coordinated with the County's Debt Management Plan to ensure that projected capital funding requirements were consistent with plans for the sale of authorized General Obligation bonds and tax notes. Funding for these three programs was set based on anticipated bond capacity necessary without raising County taxes.

Commissioners' Court approved the issuance of $18.1 Million for facility and technology projects. These tax notes were fully funded by the Debt Service fund balance for a 1-year term that came due August 15, 2019. The projects include $1.4 million for the expansion of the Medical Examiner's building, $2.2 million for the remodel of the Plano offices, $3.2 million for a new facility for the Justice of the Peace and Constable staff in Precinct No. 2 and $10.2 million for new Elections equipment and technology. There was $1 million set aside in contingency for the identified projects.

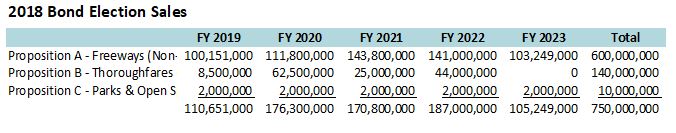

On November 6, 2018 Collin County called a bond election in the amount of $750 million for transportation and open space projects on three propositions.

Proposition A in the amount of $600 million will be for non-toll high speed highways and freeways and related service and frontage roads including participation in joint county-state and county-city projects. Studies show that congestion in Collin County and in the fast growing North Texas corridor will only get worse in the coming years. In fact, from 2000-2017, Collin County has grown by 80%, McKinney by 200%, Frisco by 350% and Prosper by 600%. Collin County will continue to grow, leading to more jobs, more economic opportunities and more traffic. To speed up travel times and avoid gridlock, new non-tolled freeways need to be built along highly traveled roads. This proposition provides for the construction of non-tolled freeways that will alleviate congestion while safely and efficiently transporting residents to work, home and play.

Proposition B for $140 million is meant for the construction on roads including participation in joint county-state and county-city projects. Congested streets in Collin County are a large problem that cannot be fixed solely with new roads. In addition to new roads, expanding and repairing existing roadways is a vital part of preparing Collin County for future growth.

Proposition C will be for the acquisition and improvement of land for park and open space purposes. Funding is $10 million total to be sold over the course of 5 years in $2 million increments. Parks and other entertainment venues provide our communities with much-needed outdoor activity and gathering places. New parks will need to be built to service our growing local neighborhoods. This proposition provides for the construction of new parks and open spaces, which will provide communal spaces for Collin County residents as well as residents from surrounding communities.

The voters of Collin County approved all three propositions. The first bond sale took place February 20, 2019.