The County Tax Assessor-Collector is designated by statute as the agent for the state Department of Motor Vehicles (TXDMV) and the State Comptroller for collection of motor vehicle fees. Under the registration statutes, every owner of a motor vehicle and taxes is required to register it with the tax assessor in the county in which the owner resides.

Tax Office Wait Times

Locations and Contact Information

Ways to renew your vehicle registration

You may register in person at any of the Tax Assessor Office locations listed below or any

participating grocery store and other subcontractor locations.

You may also register by mail or online through our

Internet Vehicle Registration Renewal System.

For online registration, credit cards are accepted for a $2.00 convenience fee. See the

Internet Vehicle Registration Renewal System website for other requirements. Both online registration and registration by mail requires us to send the sticker back to you.

Reminder: Before renewing registration, Texans will need to obtain a passing vehicle inspection at the state vehicle inspection station of their choice, unless their vehicle is exempt from inspection requirements.

You have a 90 day window to complete both your inspection and registration. You must have your vehicle inspected within 90 days before your sticker expires. You must obtain a passing inspection prior to renewing your registration. Your registration is valid through the last day of the registration expiration month.

If you are registering your vehicle in Collin County for the first time, you will need to do so in person at any of the offices listed below. See the

New Resident Registration page for details. If you are renewing your Texas registration, renewals may be completed in person at either of the Tax Assessor Offices listed below. Also, see requirements for other options to register at a local

Collin County grocery store and other subcontractor locations, or online through our

Internet Vehicle Registration Renewal System.

New Registration Fee for electric vehicles

Effective September 1, 2023, fully electric vehicles will be assessed an annual $200 fee at the time of registration or renewal, and a $400 fee at the time of new electric vehicle purchases for the initial two-year registration period. The fee will not apply to hybrid vehicles.

Revenue collected from the fee will be deposited into the state highway fund to help pay for roadway construction and maintenance projects.

Unpaid Tolls

Do you have unpaid tolls? Effective Sept. 1, 2017, all Collin County Offices began honoring the NTTA Scofflaw Registration Blocks. A Registered Motor Vehicle with 100 or more delinquent tolls will be unable to renew registration. You will need to provide a Vehicle Registration Release Form from the North Texas Tollway Authority in order to obtain your Motor Vehicle Registration Sticker.

You can clear your vehicle registration block in person by setting up a

Payment Plan or by calling NTTA at (469) 828-4619.

For additional information, visit the

North Texas Tollway Authority.

The Collin County Tax Office has NO information on NTTA tolls and administration fees.

Links and Resources

Follow

javascript: SP.SOD.executeFunc('followingcommon.js', 'FollowDoc', function() { FollowDoc('{ListId}', {ItemId}); });

0x0

0x0

ContentType

0x01

1100

Compliance Details

javascript:if (typeof CalloutManager !== 'undefined' && Boolean(CalloutManager) && Boolean(CalloutManager.closeAll)) CalloutManager.closeAll(); commonShowModalDialog('{SiteUrl}'+

'/_layouts/15/itemexpiration.aspx'

+'?ID={ItemId}&List={ListId}', 'center:1;dialogHeight:500px;dialogWidth:500px;resizable:yes;status:no;location:no;menubar:no;help:no', function GotoPageAfterClose(pageid){if(pageid == 'hold') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/hold.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Reporting.aspx'

+'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/expirationconfig.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Hold.aspx'

+'?Tag=true&ID={ItemId}&List={ListId}'); return false;}}, null);

0x0

0x1

ContentType

0x01

898

Document Set Version History

/_layouts/15/images/versions.gif?rev=43

javascript:SP.UI.ModalDialog.ShowPopupDialog('{SiteUrl}'+

'/_layouts/15/DocSetVersions.aspx'

+ '?List={ListId}&ID={ItemId}')

0x0

0x0

ContentType

0x0120D520

330

Send To other location

/_layouts/15/images/sendOtherLoc.gif?rev=43

javascript:GoToPage('{SiteUrl}' +

'/_layouts/15/docsetsend.aspx'

+ '?List={ListId}&ID={ItemId}')

0x0

0x0

ContentType

0x0120D520

350

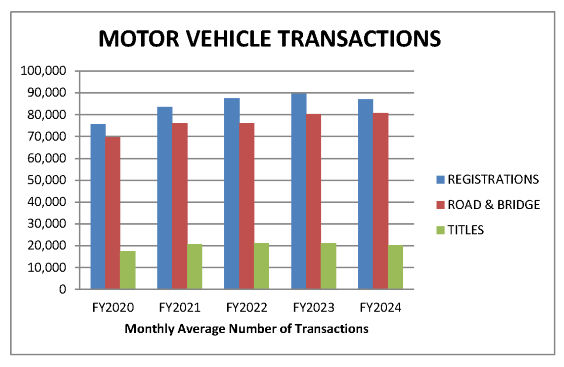

Statistics

MOTOR VEHICLE COLLECTIONS - MONTHLY AVERAGE (in Dollars)

| 2021 | $4,686,840 | $770,569 | $278,601 | $21,286,676 | | 2022 | $4,778,591 | $766,637 | $286,694 | $24,588,412 | | 2023 | $5,017,352 | $813,632 | $286,418 | $29,007,353 | | 2024 | $5,337,340 | $815,667 | $279,518 | $27,360,835 | | 2025 | $6,326,636 | $856,225 | $310,594 | $29,568,540 |

|

Follow

javascript: SP.SOD.executeFunc('followingcommon.js', 'FollowDoc', function() { FollowDoc('{ListId}', {ItemId}); });

0x0

0x0

ContentType

0x01

1100

Compliance Details

javascript:if (typeof CalloutManager !== 'undefined' && Boolean(CalloutManager) && Boolean(CalloutManager.closeAll)) CalloutManager.closeAll(); commonShowModalDialog('{SiteUrl}'+

'/_layouts/15/itemexpiration.aspx'

+'?ID={ItemId}&List={ListId}', 'center:1;dialogHeight:500px;dialogWidth:500px;resizable:yes;status:no;location:no;menubar:no;help:no', function GotoPageAfterClose(pageid){if(pageid == 'hold') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/hold.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Reporting.aspx'

+'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/expirationconfig.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Hold.aspx'

+'?Tag=true&ID={ItemId}&List={ListId}'); return false;}}, null);

0x0

0x1

ContentType

0x01

898

Document Set Version History

/_layouts/15/images/versions.gif?rev=43

javascript:SP.UI.ModalDialog.ShowPopupDialog('{SiteUrl}'+

'/_layouts/15/DocSetVersions.aspx'

+ '?List={ListId}&ID={ItemId}')

0x0

0x0

ContentType

0x0120D520

330

Send To other location

/_layouts/15/images/sendOtherLoc.gif?rev=43

javascript:GoToPage('{SiteUrl}' +

'/_layouts/15/docsetsend.aspx'

+ '?List={ListId}&ID={ItemId}')

0x0

0x0

ContentType

0x0120D520

350